Capex management for real estate portfolios - when the investment backlog becomes an EXIsTence QUESTION

The German real estate sector is facing a turning point. While portfolio holders have been able to rely on favorable refinancing and rising valuations for years, the current market situation is ruthlessly revealing: Those who have neglected their capex strategy are coming under enormous pressure. The figures speak for themselves - and for many portfolios they are becoming a question of existence or an EXIT QUESTION.

The cost shock: 50% increase in ten years

According to a study by BulwienGesa (2022), capex costs have risen by over 50% in the last ten years. Annual investment costs currently range between €10.00 and €14.00/m² (https://www.jll.de/de/publikationen/german-capital-markets-report). What this means in concrete terms only becomes clear when looking at the conditions published by the ZIA in 2021 under the title “Study on maintenance and modernization in German cities”: In A-cities, portfolio owners have to reinvest 30-50% of a monthly rent each year, in B and C-cities even 50-100% of a monthly rent.

A practical calculation example: for a 5,000 m² office building in Düsseldorf with an average rent of €12.00/m², this corresponds to annual capex costs of €50,000 to €70,000 - for ongoing maintenance alone. Added to this are modernization measures, ESG requirements and unforeseen repairs.

The investment backlog: two decades of postponed decisions

Many properties in German portfolios are 20 to 40 years old. During this time, large acquisitions were made - aided by favourable capital market conditions - but often without sufficient reserves for asset maintenance and modernization. The strategy was simple: postpone capex measures in order to meet purchase prices and yield expectations.

This calculation no longer works today. An example from our day-to-day consulting work: a portfolio of 20 office properties built between 1985 and 2005 had only undergone the most essential repairs over the years. When a due diligence was due in 2023, the technical assessment revealed an investment requirement of €180/m² - spread over the next five years. With a total area of 45,000 m², we are talking about an additional capex requirement of €8.1 million.

The operational reality: fragmentation as an obstacle to efficiency

A key problem for many portfolio holders is the fragmented service provider landscape. Property and facility management service providers are often only responsible for parts of the portfolio - with different service profiles, standards and regional characteristics. This makes centralized, uniform management of capex measures virtually impossible.

The consequences are measurable: we analysed a medium-sized portfolio holder with 80 properties and found that the decentralized allocation and lack of standardization resulted in an average of 15-20% higher costs per measure. With an annual capex volume of 2.5 million euros, this corresponds to an avoidable additional cost of 375,000 to 500,000 euros - year after year.

Added to this is the lack of resources in asset management. The reality shows: There is often a lack of time for the structured planning, budgeting and implementation of capex measures - especially in the case of nationally distributed portfolios.

Strategic capex management: prioritization as a success factor

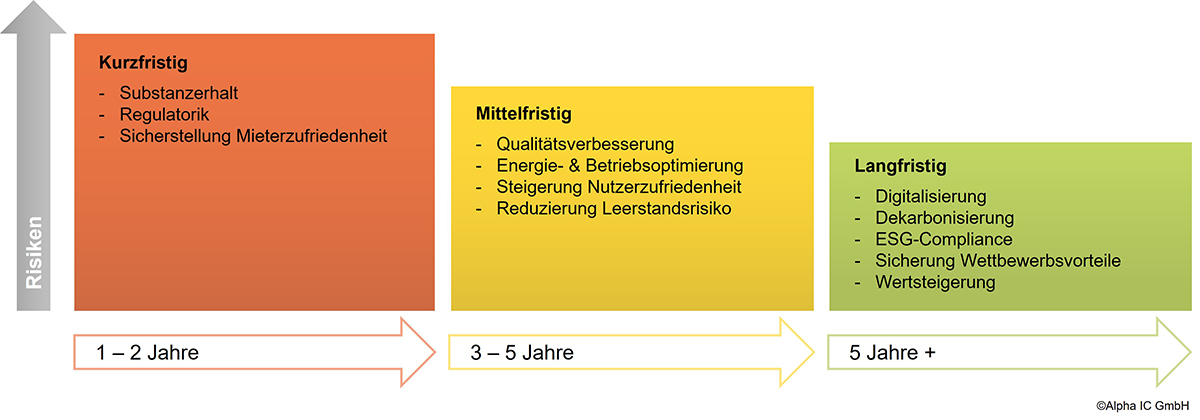

The solution is not to spend more money, but to make the right investments at the right time. Systematic prioritization according to time horizons has proven its worth:

Alpha IC capex management for real estate portfolios: centrally controlled, locally implemented

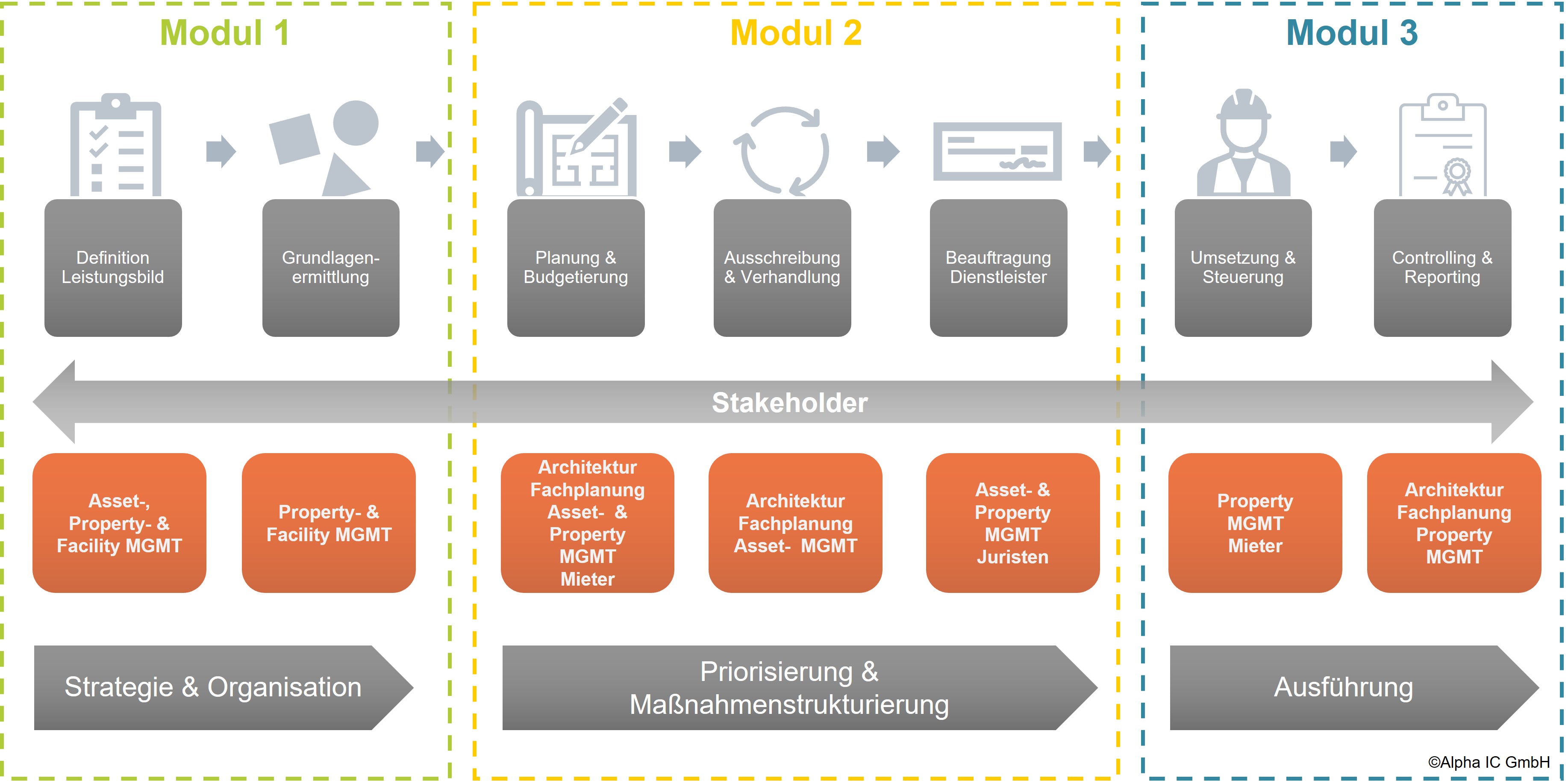

At Alpha IC, we have developed a modular, scalable capex management system that is precisely tailored to current challenges. Our approach follows a clearly structured process in which we integrate all relevant stakeholders - from planners and service providers to procurement and legal advisors to tenants and investors:

- Definition of the scope of services together with you

- Basic assessment (even with limited data)

- Planning & budgeting of measures

- Tendering & negotiation with standardized processes

- Commissioning taking all stakeholders into account Implementation & management with continuous monitoring

- Controlling & reporting for transparent performance measurement

Interdisciplinary expertise as the basis for success

Our team combines the necessary skills for successful capex management: architects and engineers for technical assessment and planning, business economists and organizational consultants for economic optimization as well as expertise from the RICS service profile, the gefma and BAMBI service specifications for standardized processes. We understand the language and challenges of service providers and investors. This dual competence is crucial, because successful capex management requires both technical understanding and commercial discipline, implementation on the property and a strategic perspective.

The time to act is now!

The current market conditions are forcing portfolio holders to rethink. Those who do not act now will face significantly greater challenges in two to three years' time. Capex costs will continue to rise, regulatory requirements are becoming more stringent and competition for quality-conscious tenants is intensifying.

At the same time, the current situation also offers opportunities: those who professionalize their capex strategy will gain sustainable competitive advantages and position their portfolio for the next market phase.

Let us analyze your capex challenges together and develop a tailor-made strategy. In an initial consultation, we will evaluate your portfolio, identify optimization potential and show you specific options for action.